RELEASE: Rep. Hill, Sen. Hagerty Introduce CFPB/Federal Reserve Reform Bill

WASHINGTON, D.C.,

September 21, 2022

Rep. French Hill (AR-02) introduced H.R.8918, the Federal Reserve Loss Transparency Act, in the U.S. House of Representatives. Senator Bill Hagerty (R-TN) has introduced a similar bill, S. 4889, in the U.S. Senate.

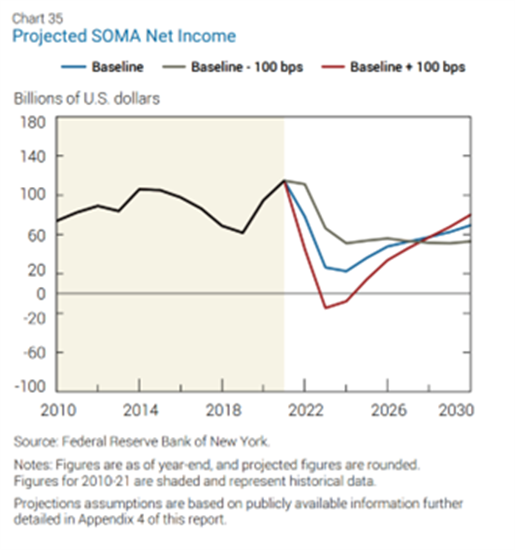

“This legislation is about restoring transparency and good governance at the Consumer Financial Protection Bureau (CFPB) and the Federal Reserve (the Fed). At a time when the central bank is carrying hundreds of billions of dollars in unrealized losses on its assets that could swing to an operating loss soon, it is grossly irresponsible for the Fed to be funding the Bureau’s radical and highly politicized agenda. This underscores why the CFPB should be funded through congressional appropriations like most federal agencies,” said Rep. Hill. “We believe the central bank should follow sound accounting practices like all other American businesses do. That is why our legislation will require the Fed to follow U.S. generally accepted accounting principles, instead of allowing our central bank to set its own accounting standards.”

“I’m pleased to introduce this legislation with Representative Hill that provides much-needed transparency and accountability at the Federal Reserve and CFPB,” said Senator Hagerty. “The public’s trust in our nation’s central bank is of paramount importance, and accounting gimmicks and backdoor transfers do nothing but erode that trust. The fact that the Federal Reserve can continue to send hundreds of millions of dollars to the CFPB—outside of the appropriations process—even when the Federal Reserve incurs significant losses should unnerve all Americans. This couldn’t happen in the real world, and shouldn’t be allowed to happen at the Fed.”

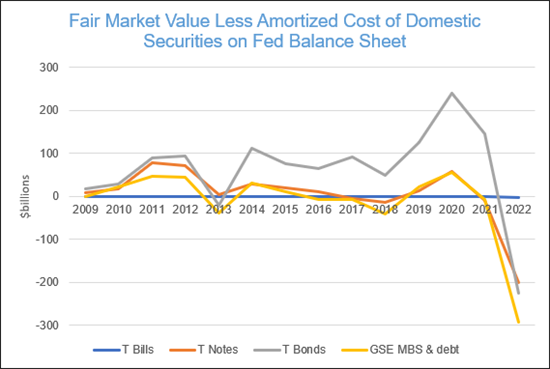

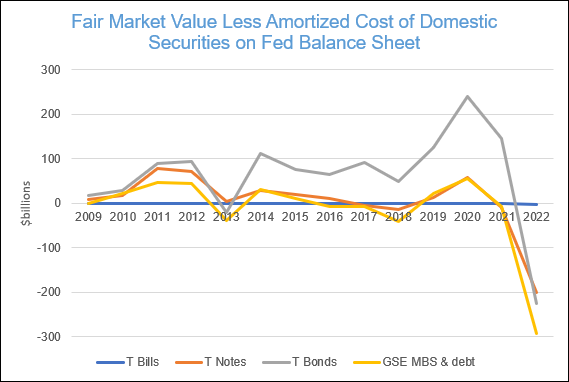

The unrecognized mark-to-market gains and losses on various categories of domestic securities on Fed's balance sheet. ** Source: Federal Reserve annual report Further Background: The Hill-Hagerty bill will prohibit the Fed from transferring money to the CFPB if the Fed incurs a loss on its balance sheet holdings. Unlike most federal agencies, the CFPB is not funded through appropriations by Congress, but rather from the Federal Reserve’s earnings. The bill also requires the Fed to calculate its net earnings in accordance with U.S. generally accepted accounting principles (GAAP). Under the Fed’s accounting rules, it does not recognize mark-to-market gains or losses on its securities portfolio when it calculates earnings, so the central bank can obscure its realized losses by recording a fake “deferred asset” on its balance sheet. Minutes of the Federal Reserve’s July Federal Open Market Committee indicate that staff projections suggest the Fed’s net income “would likely turn negative in coming months.” |