Hill, Williams in The Hill: Extend PPP Deadline PPP application deadline should be extended and fixes made to program to keep recovery going

Washington,

July 1, 2020

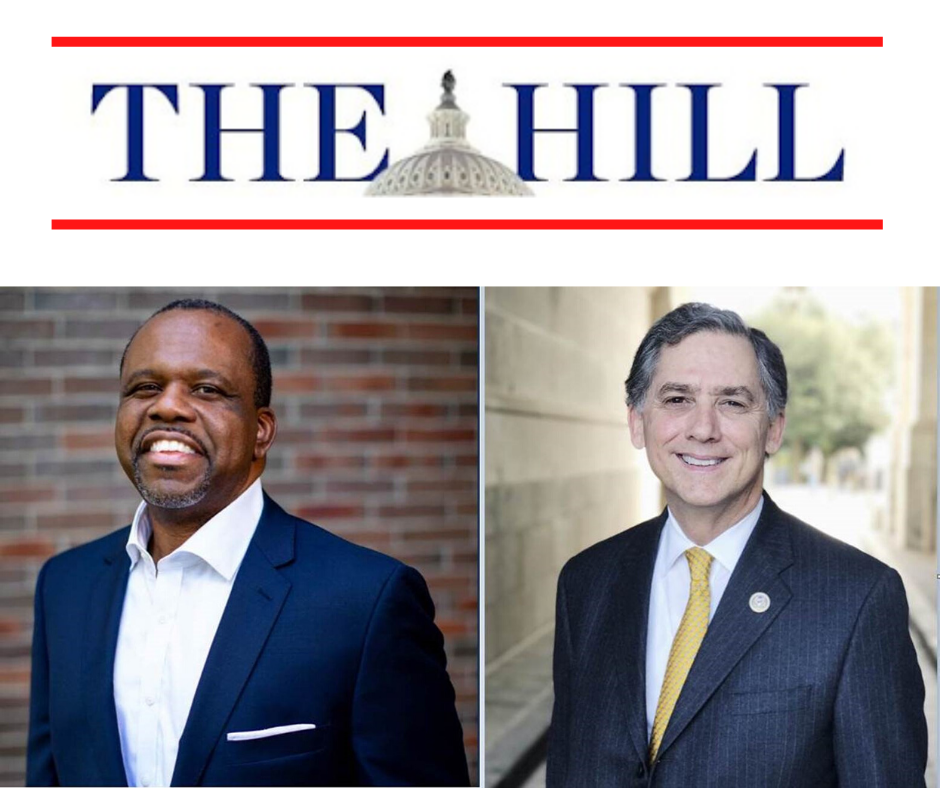

Washington, D.C — This week, in The Hill, Rep. French Hill (AR-02) and Darrin Williams, CEO of Southern Bancorp, an Arkansas-based CDFI penned an op-ed about how economic recovery in Arkansas across the country could be encouraged with the extension as well as modifications to the Paycheck Protection Program (PPP).

"The deadline to apply for PPP loans is Tuesday, but many businesses will still need assistance in the coming weeks. Congress should extend the deadline and provide countless small businesses across the country with the resources to keep their employees on payroll," said Rep. Hill. "We are faced with one of the most serious public health and economic challenges our country has known, and businesses and the communities they support need a helping hand. Extending the PPP would provide that help." The full op-ed is below. The Hill The CARES Act created the extremely successful Paycheck Protection Program which has helped small businesses maintain payroll during these challenging times. The U.S. Department of Treasury (Treasury), the Small Business Administration (SBA) and over 5,000 lenders took quick action to launch this program and have provided an unprecedented 4.8 million loans. However, since its launch on April 3, 2020, the program has gone through many iterations of regulatory guidance creating significant lender and borrower confusion. The Treasury and the SBA have released 21 interim final rules and 47 frequently asked questions over 17 different releases. The National Federation of Businesses (NFIB), which represents small businesses, reported their PPP webinars have consistently had upwards of 10,000 attendees. Previously, if a webinar received 1,000 attendees, it was considered very well-attended. Similarly, lenders have expressed grievances. As Eduardo Sosa, an SBA Lending Senior Vice President from Amarillo Bank, stated in his testimony before the House Committee on Small Business on June 17, 2020, “As an experienced lender, I’ve never once fully understood how to make a PPP loan from beginning to end—and still don’t.” Congress has tasked lenders as the conduit for this funding. However, given the changing landscape, lenders are understandably frustrated. As a result of this confusion, lenders are now reticent to underwrite new loans – the opposite of what our economy and small businesses need. The deadline to apply for the PPP is June 30, 2020, but an additional $140 billion of PPP funds remain unobligated. To ready our small business, lenders and entrepreneurs for learning how to “live with the virus” and move towards reopening, we recommend Congress take action on the following:

|