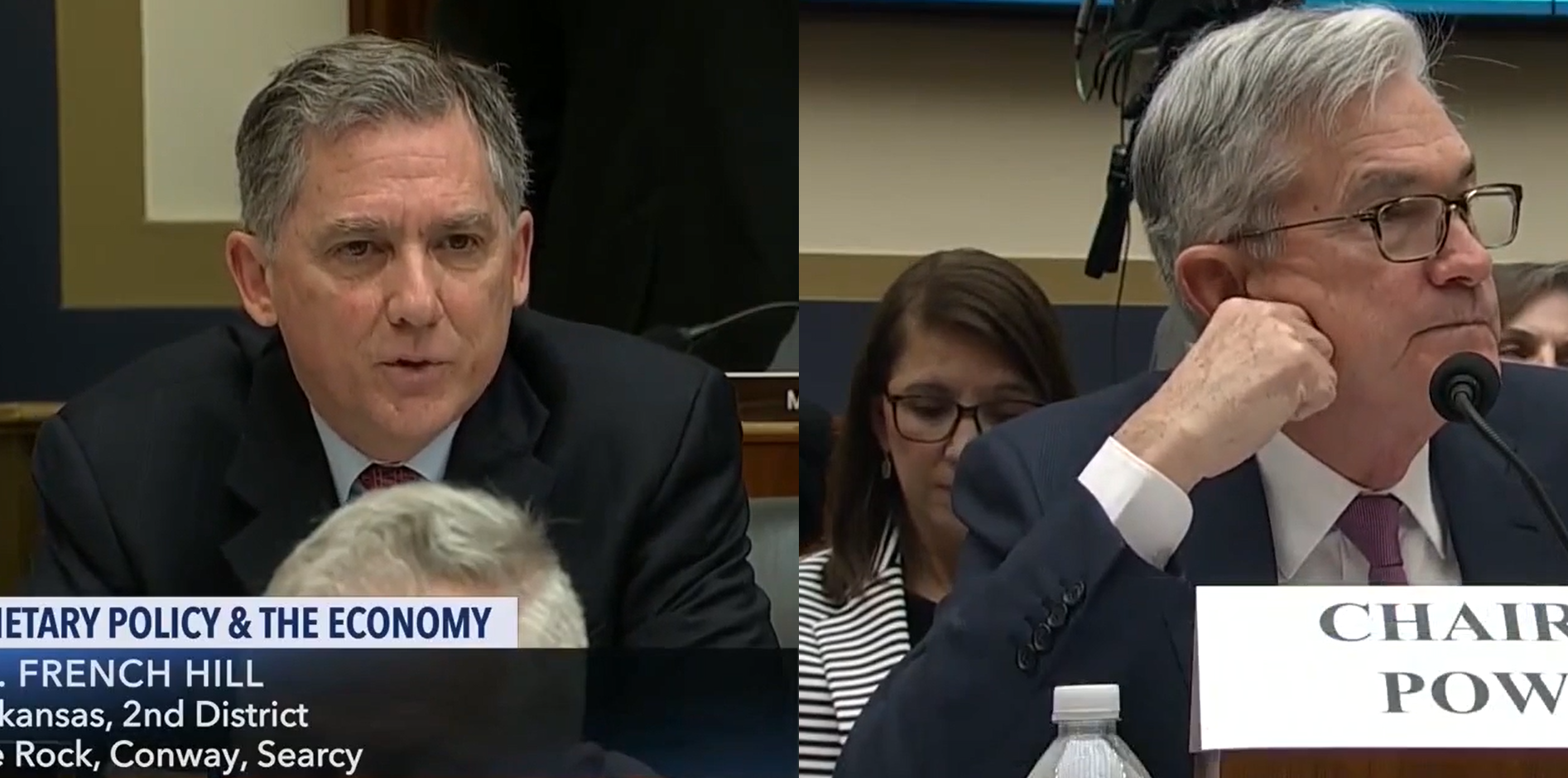

Click on the picture above to watch Rep. Hill's opening statement and questions from this week's hearing with Fed Chairman Powell. |

WASHINGTON D.C. — This week, during a House Financial Services Committee hearing, Rep. French Hill (AR-02) questioned Chairman of the Board of Governors of the Federal Reserve System, Jerome Powell, on the use of a digital dollar, China’s GDP-to-debt ratio, and the bond market. In his opening remarks, Rep. Hill echoed the comments of Ranking Member McHenry about the Community Reinvestment Act:

“I know this received a lot of attention. I’ve read Governor Brainard’s very comprehensive views on the topic, and we had Mr. Otting here recently to discuss the OCC’s point of view. As a former community banker, it is my view that we really should have ultimately one approach to CRA among the financial services regulatory agencies. I’ve had forty years of dealing with inconsistent delivery of regulatory proposals, and so I do think it ultimately will be productive for us to have one approach to that regulation and to modernize it for the digital world that we live in today.”

Key Excerpts:

Rep. Hill: Would you advise our committee, or ask the Federal Reserve to advise our committee, on what legal authorities the Federal Reserve might require in order to consider the use of a digital dollar?

Chairman Powell: Yes, that's a good question and it’s one we’re looking at. A lot of it would be dependent on the design of that currency.

Rep. Hill: One thing we also talked about, and we’ve had a lot of discussions about in our FinTech taskforce here, is about Europe’s approach to this idea of a payment provider license, which is now part of their financial services code. It is part of the open banking movement and is the idea that one would have a regulatory license here in the United States for being a payment provider, which might be a bank or a non-bank. Is that something the Federal Reserve is looking at as well?

Chairman Powell: I wouldn’t say we’re specifically focused on that. More broadly, we think it’s a good idea to look at the whole landscape of the oversight of our payment system, and that would be a piece of it. As you may know, Governor Brainard talked about that in one of her speeches last week.

Rep. Hill: Last month the Chinese regulators bailed out Hengfang Bank. It was with a $14 billion loan that they arranged through one of their sovereign wealth funds. The Chinese banking assets at $41 trillion are 47% of world GDP. Is instability in the Chinese banking industry posing a financial threat to the global financial system? Is it a financial "virus" like the physical virus that they’ve already contributed?

Chairman Powell: Generally, as I am sure you are aware, China has had very high debt-to-GDP ratio for an economy at its stage of development, and it includes the banking system. The government has actually for several years now been taking measures led by, I think, the Central Bank to try to control the growth of debt, and they’ve stuck to that through the last couple of years even though those were challenging years economically for them. It’s something they are addressing. The other thing to say is that they have plenty of fiscal space. Fiscally, they have plenty of power to respond to a downturn. I would not go so far as to say their debt is a systemic threat to the world economy or anything like that, but it is something that they need to, and are, addressing.

Rep. Hill: It’s something that I think deserves review. Mr. Barr talked about their misallocation of resources. At 47 percent of global GDP, that seems like an over allocation in the banking sector in China and could pose a threat to our system.

...

Rep. Hill: In your report, you talk at length in the financial stability section about the decline in bond yields, particularly in the high-yield market. The ratings have fallen, and I was looking at a mutual fund annual report the other day which said that a particular concern is the continuing high rate of issuance of BBB bonds, the lowest category of investment grade rated bonds. If the economy stumbles and the rating downgrades issue continues, it could be a flood of fallen angels. This particular mutual fund said they’re staying away from the low end of the high-yield market. Are you concerned about the high-yield market?

Chairman Powell: Well, that's the so-called "BBB cliff," and the idea is that there are a handful of very large issuers which if they were downgraded would then be non-investment grade. And the idea is that some holders are not permitted by the terms of the agreements with their investors to hold non-investment grade, which might trigger sales. So that's an issue we have been monitoring for some time now. With leverage lending more generally, yes, we’re monitoring it very carefully. You do see low compensation for risk taken. You see high leverage. You see a lack of covenants; you see all of that. It’s a complicated picture, though. That paper is now largely held in CLOs and mutual funds and the exchange rated funds rather than on bank balance sheets, and those vehicles tend to be stably funded, in the sense that their liabilities are actually longer than the expected maturity of the underlying instruments that are helpful.