Rep. Hill Leads First Artificial Intelligence Task Force Hearing

Washington,

June 26, 2019

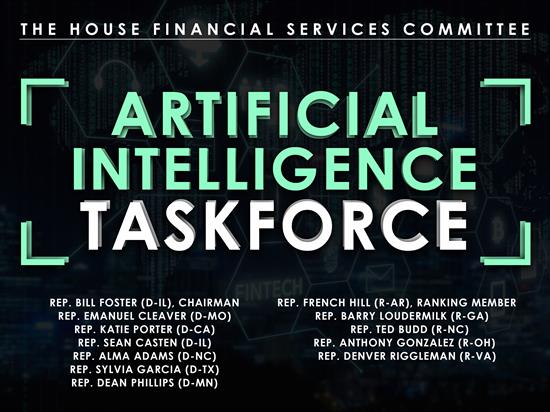

WASHINGTON, D.C. — Ranking Member of the House Financial Services Committee Task Force on Artificial Intelligence (AI), Congressman French Hill (AR-02), helped lead the newly formed task force in its first hearing entitled, "Perspectives on Artificial Intelligence: Where We Are and the Next Frontier in Financial Services."

Highlights of Congressman Hill's remarks as prepared are copied below. Over the next few months, I look forward to working with my colleagues on both side of the aisle to find ways to foster innovation through the use of artificial intelligence for both disruptive innovators and incumbent financial players, small and large. The use of AI has grown exponentially in the last few years. AI has the potential to improve human life, economic competitiveness and societal challenges. A recent GAO testimony identified four high-consequence sectors that are leveraging AI including: Cybersecurity, Automated Vehicles, Criminal Justice, and Financial Services. Today’s timely hearing will discuss how AI is impacting and influencing financial services. AI can be used to gather enormous amounts of data, detect abnormalities and solve complex problems. Financial institutions are already experimenting with these resources to enhance and streamline financial institutions’ BSA/AML compliance, CRA requirements, fraud detection, and real estate valuations, all while reducing cost levels. Also, AI can create better efficiencies for underwriting and reaching underbanked communities. Algorithmic driven lending is proliferating online and transforming everything from personal loans to small-business borrowing. A recent National Bureau of Economic Research working paper found that online financial companies discriminate 40% less than loan officers who make decisions face-to-face. I know Mr. Merrill of ZestFinance, who grew up in my district in Conway, Arkansas, has been doing some interesting things with regards to AI and underwriting and I look forward to hearing about it. All that to say, the use of artificial intelligence and machine learning is not without its challenges and questions – just like any other technology advancement. Henry Kissinger published an article in The Atlantic outlining concerns relating to the rise of artificial intelligence. He argues that we’re in the midst of a technical revolution that could culminate in a world “relying on machines powered by data and algorithms and ungoverned by ethical or philosophical norms.” He goes on to say that “Truth becomes relative [and] information threatens to overwhelm wisdom.” While it remains to be seen whether Mr. Kissinger’s concerns are fully proved, I do heed his advice. As policymakers, we need to ensure we are asking the right questions about appropriate testing and evaluating this new technology, so it ultimately benefits the end consumer. Lastly, I would be remiss if I didn’t mention the potential of job loss with the advent of AI. I’m sure this topic will arise as we move through these hearings. The World Economic Forum argues that machines and algorithms in the workplace are expected to create 133 million new roles but cause 75 million jobs to be displaced by 2022 which means, net, 58 million jobs will be created. In my view, I believe this will contribute positively on the economy and the future of work. People might be putting the cart before the horse on the number of displaced jobs. I start this journey in the “cup half full” camp and am optimistic about our future. I look forward to continuing to seek out answers through our work on this Task Force. We will work to find bipartisan solutions that will benefit the consumer while enhancing companies’ bottom line. I look forward to working with my colleagues towards that goal. |