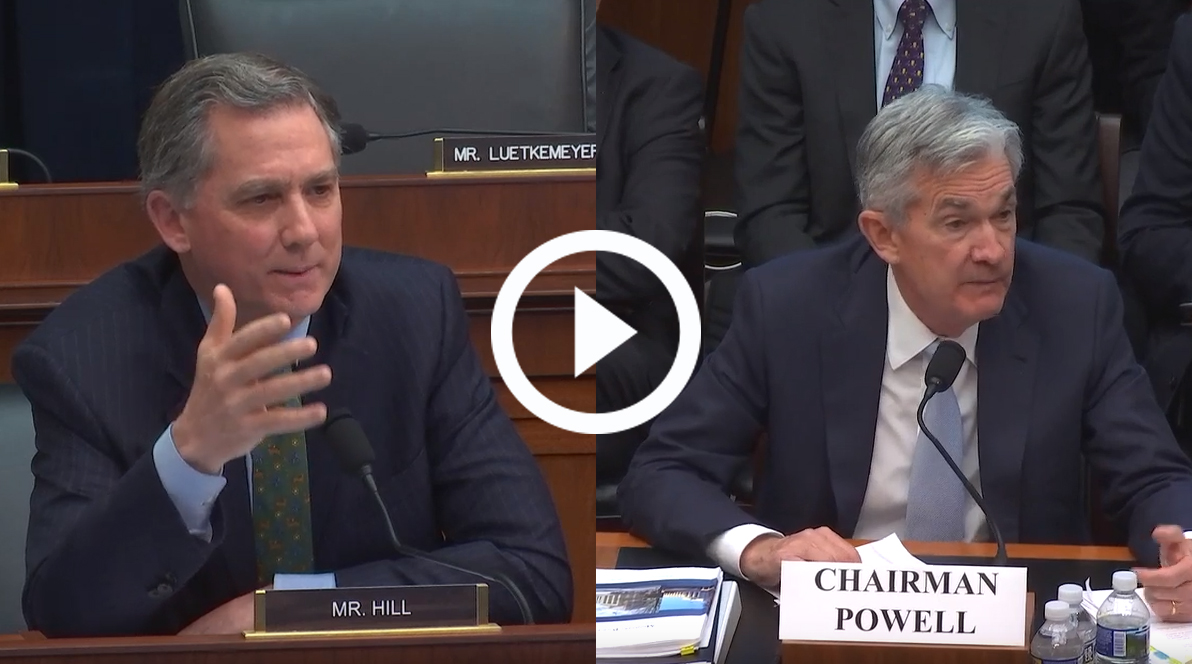

Rep. Hill Questions Fed Chairman Jerome Powell on the U.S. Balance Sheet

Washington,

February 28, 2019

Tags:

Financial Services

Congressman Hill: We are delighted to have you and thank you for your steady hand at the Federal Reserve. We are grateful for your time answering our questions. I want to follow up on Mr. Barr's questioning on the balance sheet, looking for some detail with the normalization process. The balance sheet was down about $368 billion January to January, about a 9% reduction. If you think about the size of the economy, and your comments about the future balance sheet size, it occurred to me that at if the fed balance sheet was down 10% of GDP, so $2 trillion, as opposed to the 6% or 7% it was before the financial crisis, that at this rate it would take about five years to normalize in that range. As you begin to think about the balance sheet, that would be about 16 years after the financial crisis that the balance sheet would be normalized. If you look at the rolling off of the portfolio, what range of years do you think it would reach? I am looking for a range of the denominator. Chairman Powell: That is right. That will be about 16% to 17% of GDP, where it was 6% before. The difference is currency is a bigger part of it and the same thing with reserves. Congressman Hill: When you look at the composition--I know you testified that you prefer a treasury only balance sheet, and you've heard discussions previously in this committee where we recognize in periods of crisis that the fed could take other assets, but many of us believe they should've swapped those back out at the treasury, so the central bank maintains only a treasury portfolio--do you still hold that view? And what are your views on Mr. Quarles comments last week that he would look at limited sales of the MBS portfolio? Chairman Powell: We have said we want, primarily, a treasury balance sheet. We've also said we hold the possibility that at some point, this is not something decided or anything in the near term, we would do limited sales of MBS to hasten the process. We have a bunch of decisions to make on the balance sheet, and the one on MBS sales is closer to the back of the line. We will be working through that in a careful way. Markets are sensitive to this. Congressman Hill: I know that the markets would connect with those sales. I would encourage that. I want to switch gears and talk about another U.K. issue that is not Brexit. That is the subject of open banking. The U.K.'s payment services directive, which is also termed informally as open banking, and I would like to get, if not your thoughts today, your thoughts in writing about the promise of open banking as it benefits more competition. This is where consumers have access to all their data with brokerage banking that they get to control. It's a way to have better data security and more consumer security. It has been required now of the major banks in the U.K. Are you familiar with that? Chairman Powell: I am not familiar with the U.K. aspect of it. I'm familiar with the fact it is a very interesting and important issue here. Congressman Hill: As we look at FinTech in our markets and we look at ways to level the competitive playing field between the G-SIFI's and everybody else, I think this will be an important issue and I invite your comments in the future on that. |