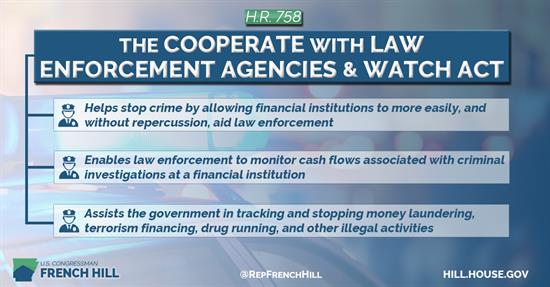

Hill’s bill protects banks working with law enforcement during criminal investigations

Hill’s bill protects banks working with law enforcement during criminal investigations By The Ripon Advance U.S. Rep. French Hill (R-AR) on Jan. 24 sponsored a bipartisan bill that would provide a safe harbor for financial institutions that maintain a customer account at the request of a federal or state law enforcement agency, according to the congressional record summary. The…